(877) 838-8384 — Info@RetallickFinancial.com

Are you aware that your retirement account may have a Required Minimum Distribution (RMD)?

Complimentary Webinar:

“Making The Most of RMD’s”

Learn About RMDs

- What, exactly, is an RMD and why it matters right now

- The impact an RMD may have on your retirement

- Understanding how an RMD is calculated

- New laws regarding RMDs and how they may affect you

Retirement Plans & RMD Impact

- 401(k), 457(b), SEP, SIMPLE IRA, & traditional IRA plans

- Defined pension plans and other qualified plans

- Do RMDs affect Roth IRAs or profit sharing plans?

- The SECURE Act of 2019

RMDs - Laws & Taxes

- Recent RMD law change & its potential impact on you

- RMD rules and taxation calculations

- Calculating your RMD (warning: mistakes are costly!)

- Special rules for certain plans

Important Facts About RMDs

- How marital status impacts your RMD

- Special withdraw exceptions

- Retirement income strategies related to RMDs

- Post-death distributions and facts

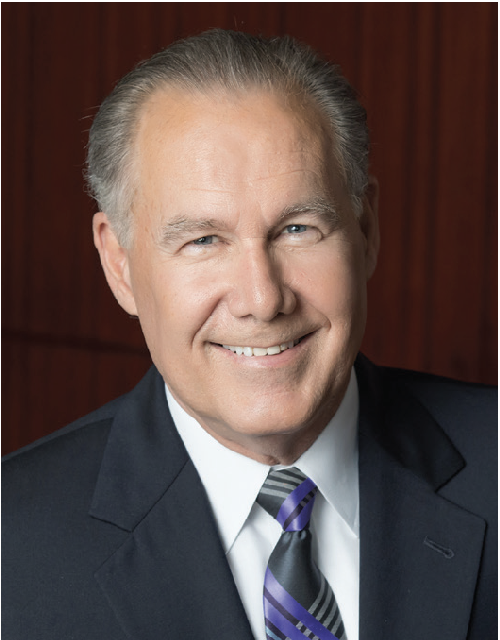

About Your Presenter

As vice president of Advanced Markets for Allianz Life Insurance Company of North America (Allianz Life®), Waldean Wall is responsible for assisting the company’s financial professionals and their clients with financial, estate, and retirement-planning goals.

Prior to joining Allianz Life in 2002, Wall was a leaders-level advisor and advanced markets trainer at New England Financial. Before that, he was a tax consultant in Minneapolis.

Wall earned his MS in financial services (MSFS) from the Institute of Business and Finance and a master’s degree from Bethel University in Arden Hills, MN. He holds a Chartered Financial Consultant (ChFC) designation as well as FINRA Series 7 and 63 securities registrations and has earned the enrolled agent (EA) designation.