(877) 838-8384 — Info@RetallickFinancial.com

Did you miss our live webinar?

Or perhaps you have some questions and would like to rewatch it?

If so, please click the link below to watch the recording.

Do you have any questions? Would you like to set up a 15 minute phone call or a one-on-one appointment in our office? If so, fill out the form below. We are happy to help!

Did you know that you could be penalized up to 50% in taxes if you do not withdraw the correct RMD from your account at the proper time?

Learn About RMDs

- What, exactly, is an RMD and why it matters right now

- The impact an RMD may have on your retirement

- Understanding how an RMD is calculated

- New laws regarding RMDs and how they may affect you

Retirement Plans & RMD Impact

- 401(k), 457(b), SEP, SIMPLE IRA, & traditional IRA plans

- Defined pension plans and other qualified plans

- Do RMDs affect Roth IRAs or profit sharing plans?

- The SECURE Act of 2019

RMDs - Laws & Taxes

- Recent RMD law change & its potential impact on you

- RMD rules and taxation calculations

- Calculating your RMD (warning: mistakes are costly!)

- Special rules for certain plans

Important Facts About RMDs

- How marital status impacts your RMD

- Special withdraw exceptions

- Retirement income strategies related to RMDs

- Post-death distributions and facts

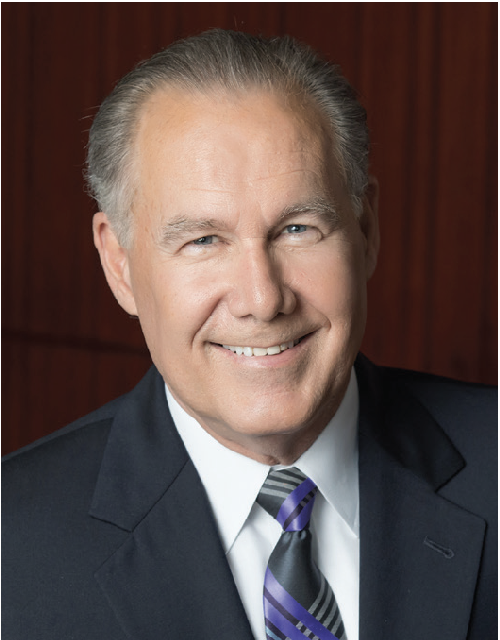

About Your Presenter

As vice president of Advanced Markets for Allianz Life Insurance Company of North America (Allianz Life®), Waldean Wall is responsible for assisting the company’s financial professionals and their clients with financial, estate, and retirement-planning goals.

Prior to joining Allianz Life in 2002, Wall was a leaders-level advisor and advanced markets trainer at New England Financial. Before that, he was a tax consultant in Minneapolis.

Wall earned his MS in financial services (MSFS) from the Institute of Business and Finance and a master’s degree from Bethel University in Arden Hills, MN. He holds a Chartered Financial Consultant (ChFC) designation as well as FINRA Series 7 and 63 securities registrations and has earned the enrolled agent (EA) designation.